Prediction markets have become one of the most exciting ways to bet on the future. From political elections to economic trends and sporting events, these platforms let you trade on the likelihood of real-world events happening.

Think of it as a mix of forecasting and investing—where the collective wisdom of the crowd shapes the odds. But how do prediction markets actually work? And where can you start betting on future events?

In this article, I’ll break down everything you need to know about prediction markets and highlight some of the top platforms like Kalshi and PredictIt. By the end, you’ll have a clear understanding of how these markets operate and where you can start making your own predictions today. Let’s dive in!

Introduction to Prediction Markets

Prediction markets are a unique way to bet on future events. Instead of betting on companies like in the stock market, you’re betting on real-world events—things like elections, economic trends, or even the weather. It’s an interesting way to make predictions about what might happen in the future!

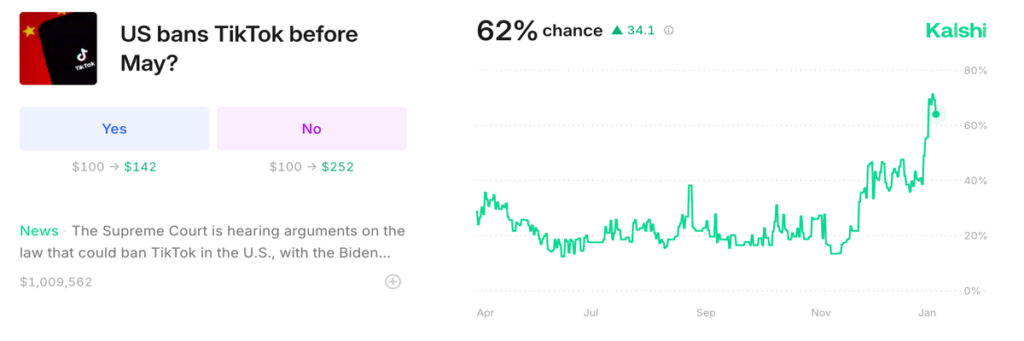

For example, you can bet on whether or not the U.S. government will ban TikTok. On Kalshi, a popular prediction market site, there’s currently a 62% chance that TikTok will be banned before May 2025. If you think it will happen, you can risk $100 to win $152.

On the other hand, if you think TikTok won’t get banned, you can choose the “No” option, risking $100 to potentially win $252. These odds reflect the market’s collective opinion, and you can even track how public sentiment changes over time.

For instance, on November 19, 2024, the market thought there was just a 13% chance of a TikTok ban, showing how predictions can shift as new information comes in.

How Do Prediction Markets Work?

Prediction markets are all about trading contracts based on what people think will happen in the future. As more people buy and sell contracts, the market adjusts to reflect changing opinions and fresh news.

In simple terms, it’s a way for the crowd to figure out how likely an event is to happen, with the prices of contracts changing all the time as more information comes in.

Buying & Selling Contracts

In these markets, each contract represents a possible outcome, and its price shows how likely the market thinks that outcome is.

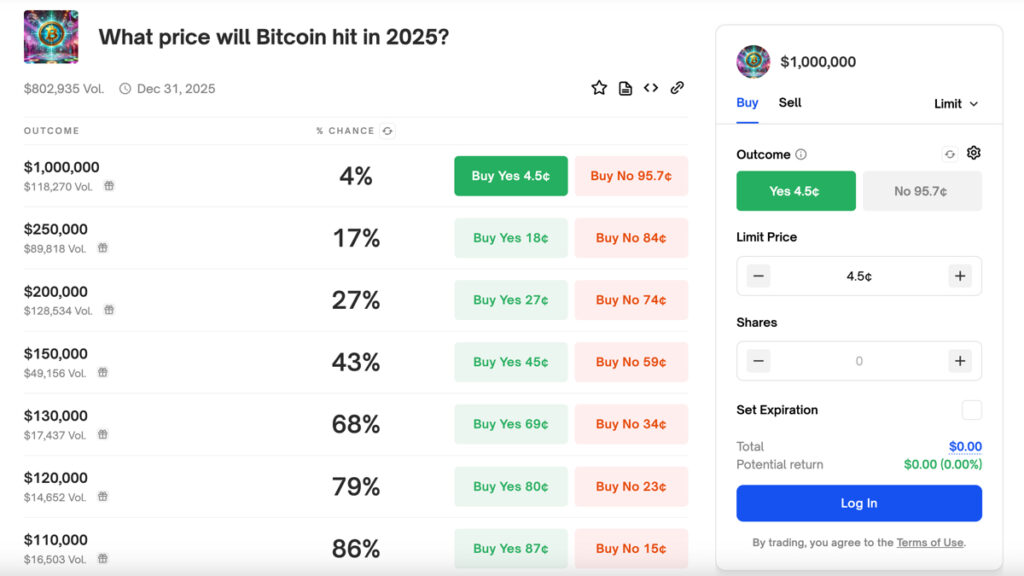

For example, on Polymarket, there’s a market about whether Bitcoin will hit $1 million by 2025. Each “Yes” contract is priced at 4.5 cents, while each “No” contract is priced at 95.7 cents.

As more people trade, the prices keep adjusting based on the market’s changing views.

How Market Prices Reflect Probabilities

The price of a contract tells you how likely the market thinks an event is to happen.

Take the Bitcoin example: the 4.5-cent price of the “Yes” contract means the market believes there’s a 4.5% chance that Bitcoin will reach $1 million by 2025. The 95.7-cent price of the “No” contract means there’s a 95.7% chance that it won’t.

Sometimes, these prices won’t add up to exactly 100%. This happens because of something called a “spread,” which is the difference between the buying and selling prices.

This gap can happen due to different opinions in the market or limited liquidity, but it still lets people trade contracts even if the numbers don’t line up perfectly.

Best Prediction Market Websites for Betting & Trading

If you’re looking to jump into prediction markets, you’ve come to the right place. From sports to politics, there are some great platforms that let you bet and trade on all kinds of events.

In this section, I’ve put together a list of the top sites you should check out. Let’s take a look at what each one brings to the table!

1. Kalshi

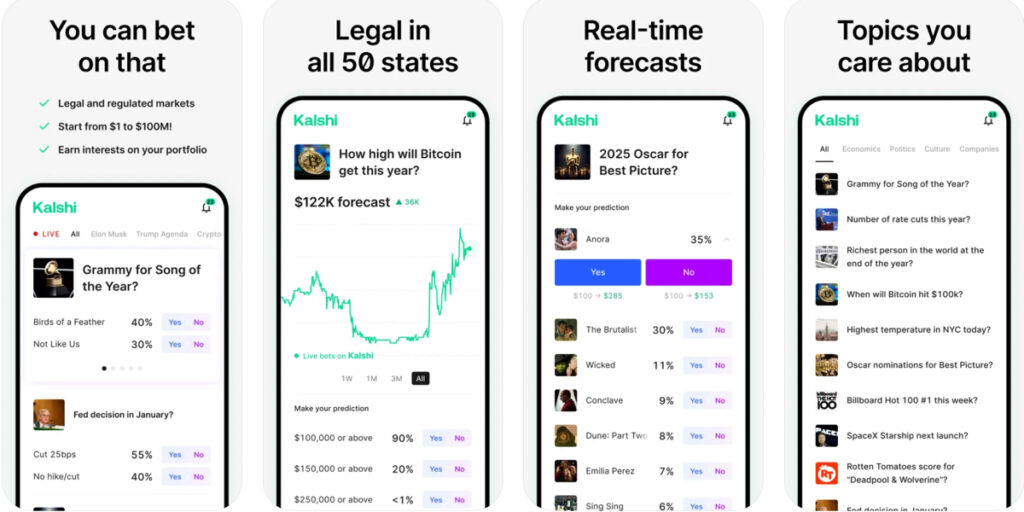

Kalshi is the first U.S.-regulated prediction market where you can trade contracts based on the outcome of future events.

Launched in July 2021, Kalshi offers a wide variety of markets, from politics and economics to climate events and pop culture. You can bet on everything from the U.S. debt crisis to the release date of GTA 6!

Contracts on Kalshi are affordable, priced between 1¢ and 99¢, and if you’re correct about the outcome, you can earn up to $1 per contract. The platform is easy to use, with high liquidity, meaning you can buy and sell contracts as the market changes.

Backed by investors like Charles Schwab, Kalshi provides a unique opportunity to diversify your investments with something a little different.

2. PredictIt

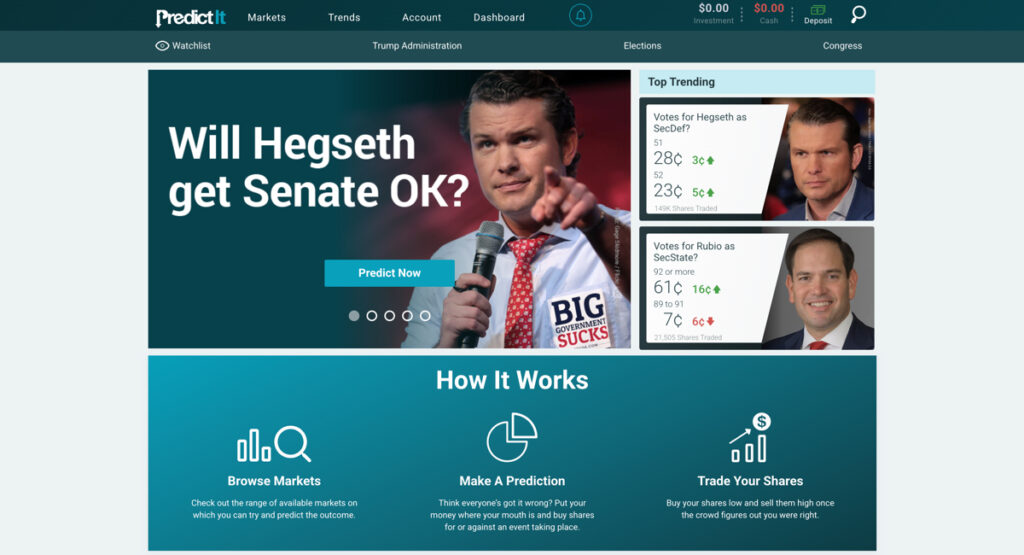

PredictIt.org is a fun and interactive platform where you can test your political instincts and even make some money while you’re at it. Based in New Zealand, it lets you trade shares on a variety of U.S. political and financial events—think elections, Supreme Court rulings, and major global developments.

This popular prediction market works just like Kalshi: you buy and sell shares on future outcomes, with prices ranging from 1¢ to 99¢. If you’re right, you get $1 per share, but if the event doesn’t happen as predicted, the shares expire worthless.

PredictIt operates under a No Action letter from the Commodity Futures Trading Commission (CFTC). There are some investment limits, though—each question has a $850 cap, and only 5,000 traders can participate in each event. This adds a unique, competitive feel to the market.

Backed by Victoria University of Wellington, PredictIt offers a fun and educational experience for anyone looking to test their political knowledge.

3. Crypto.com

Crypto.com is stepping into the prediction market world with its new sports trading product “Crypto.com Sports,” which launched in December 2024.

This platform allows users to make predictions on the outcomes of major sports events, such as the NFL Super Bowl, NHL Stanley Cup, and NCAA Football Championship.

It operates using “event contracts,” which are regulated derivatives overseen by the Commodity Futures Trading Commission (CFTC) under the Commodity Futures Modernization Act (CFMA).

Though it’s still in its early stages, what really stands out is how user-friendly it is. You can access it in all 50 U.S. states through the Crypto.com mobile app or website, and the wide range of contract prices makes it accessible to all budgets.

Plus, if you’re into crypto, you’ll love that you can trade over 350 cryptocurrencies and instantly convert them to USD for betting. It’s the perfect mix of sports and crypto for those looking to try something new!

4. Robinhood

Robinhood, best known for its commission-free stock trading, has also recently started offering “event contracts” as part of its platform.

Following Kalshi’s legal victory against the Commodity Futures Trading Commission (CFTC), Robinhood introduced prediction betting markets for the 2024 U.S. presidential election, allowing users to trade on outcomes involving Donald Trump and Kamala Harris.

In addition, Robinhood CEO Vlad Tenev has hinted at plans to expand into federally regulated event contract markets for sports, politics, entertainment, economics, and more.

This move aligns perfectly with Robinhood’s goal of offering fresh and accessible trading opportunities. I’m excited to see how this feature evolves and what creative markets they’ll roll out next—it feels like they’re just getting started!

Exploring Different Types of Prediction Markets

Prediction markets aren’t just about making bets—they’re about turning your knowledge and instincts into real outcomes. With so many options out there, it’s easy to find one that matches your interests.

Here’s a closer look at a few of the different types of markets and what makes them exciting:

- Political Prediction Markets: These are all about predicting political outcomes, like elections or major policy changes. If you follow politics closely, these markets let you put your predictions to the test, whether you’re guessing who’ll win the next election or how a bill will fare in Congress.

- Sports Prediction Markets: If you’re a sports fan, this is your chance to trade on outcomes from games, seasons, or even individual player stats. Whether it’s predicting the winner of the Super Bowl or how a player will perform, sports markets tap into your knowledge of the game and the players.

- Economic & Financial Prediction Markets: For those who live and breathe finance, these markets are a goldmine. You can trade on things like interest rate hikes, stock market trends, or GDP growth. If you follow economic news or just have a good gut feeling, this could be a great option to explore.

- Entertainment & Pop Culture Markets: Ever been confident about who’s winning an Oscar or which movie will crush it at the box office? Some markets let you put money on these outcomes. They’re not as serious as politics or sports, but they’re a lot of fun—especially if you’re a pop culture junkie.

Each type of market provides a different challenge, allowing you to trade on what you know, whether it’s politics, sports, or global events. No matter where your interests lie, there’s always a prediction market that fits your expertise.

Pros & Cons of Prediction Market Betting

| Pros ✅ | Cons ❌ |

|---|---|

| Potential To Make Money: Correct predictions lead to real money winnings. | Risk of Losing: Wrong predictions mean losing money. |

| Low Barrier to Entry: Start with small investments and low stakes. | Steep Learning Curve: Hard to understand for beginners. |

| Variety of Markets: Bet on sports, politics, pop culture, and more. | Emotions Can Affect Decisions: Excitement can cloud your judgment. |

| Collective Wisdom: More people = better, more accurate predictions. | Not Available Everywhere: Access may depend on location. |

| Learn as You Go: Gain knowledge about topics like politics and the economy. | Regulatory Uncertainty: Legal changes may affect operations in the future. |

Are Prediction Markets Legal in the USA?

Prediction markets are an exciting and innovative way to forecast uncertainty. However, their legal status in the United States is a bit complex and depends on several factors, such as the platform’s structure and the types of events being traded (or wagered on).

Here’s a basic overview of how prediction markets stand in terms of U.S. law:

Regulation by the CFTC

Prediction markets that involve financial contracts are typically regulated by the Commodity Futures Trading Commission (CFTC). This federal agency oversees markets where people can trade based on the likelihood of future events, like economic forecasts or political outcomes.

If a platform is registered with the CFTC, it can legally operate in the U.S. under strict rules to ensure fair trading and consumer protection.

Exemptions for Non-Financial Prediction Markets

Not all prediction markets are treated the same way. Some platforms focus on non-financial outcomes, such as measuring public opinion or making predictions about less financially impactful events.

These types of markets may be exempt from the strict financial trading rules that govern gambling or financial markets. However, even these platforms need to follow specific guidelines to ensure they aren’t misleading or operating as illegal gambling.

State-Level Regulations

In addition to federal laws, state laws play a crucial role in determining whether prediction markets are allowed. Some states have specific laws regulating online betting and financial transactions, which can restrict or limit the types of prediction markets that can operate.

For example, some states may prohibit online betting or impose limits on certain types of markets, even if they are legal in other states. This means that while a platform may be legal at the federal level, it may not be accessible in every state.

Users should always check their local laws to ensure they are complying with the rules in their state.

Gambling vs Financial Trading

A key factor in the legality of prediction markets is whether they are classified as gambling or as financial trading. Gambling markets are often heavily regulated and can be illegal in some states.

On the other hand, markets structured like financial contracts are generally subject to less regulation, as long as they are set up properly and don’t violate laws about securities or commodities.

The distinction between gambling and financial trading can sometimes be blurry, and the rules differ depending on the specific market and the event being predicted.

How To Get Started With Prediction Betting Markets

Ready to dive into prediction markets? Here’s how to get started and make the most of it:

Choosing the Right Prediction Market Website (or App)

Picking the right platform is key to having a smooth experience:

- Trustworthy and Safe: Choose a prediction market website or app with a good reputation and proper security. You want to feel confident your money and personal data are safe.

- Variety of Markets: Find a site with a good range of events to bet on—whether politics, sports, or entertainment. More options mean more chances to bet on what you know best.

- User-Friendly: A simple, clean interface makes all the difference. Look for a platform that’s easy to navigate, so you can focus on the bets, not figuring out how to use the site.

- Know the Fees: Watch out for platform fees and commissions. Understand what you’ll pay to avoid surprises down the road.

- Active Prediction Markets: A site with plenty of participants is crucial. The more active the market, the easier it is to place bets and get fair odds.

Tips for New Traders

Here are a few quick tips to help you get the hang of it:

- Start Small: Begin with small bets to get comfortable. You’ll learn the ropes of prediction markets without risking too much money right away.

- Do Your Research: The more you know about an event, the better your chances. Follow trends and stay informed to make smarter investments.

- Watch Market Movements: Pay attention to how odds shift. Big changes can signal new opportunities or risks, so stay alert.

- Don’t Put It All On One Bet: Spread your bets across different markets. It’ll help reduce the risk of a big loss.

- Learn from Others: Check out what experienced traders are doing. Platforms with active communities often have great tips and strategies.

Best Practices for Managing Risk

Risk management is key to staying in the game:

- Set a Budget: Decide upfront how much you’re willing to risk and stick to it. Don’t go overboard, no matter how tempting.

- Use Stop-Loss Options: If the platform allows, use tools to automatically limit your losses. It’s an easy way to protect yourself from big swings.

- Don’t Get Emotional: It’s easy to get caught up in the excitement, but avoid making rash bets. Stick to your strategy and don’t let emotions drive decisions.

- Understand the Odds: Take the time to assess the probabilities of outcomes. Don’t just go with gut feeling—be strategic.

- Review Your Performance: Look back on your past bets to see what worked and what didn’t. Learning from your own experience will improve your future decisions.

Conclusion: Are Prediction Markets the Next Big Thing in Betting?

Prediction markets are definitely shaking things up in the sports betting and online gambling world.

They offer a fresh, exciting way to get involved by tapping into collective knowledge, and the variety of events you can bet on—sports, politics, entertainment, and more!—is pretty amazing. As more people catch on to the thrill of predicting outcomes, it’s easy to see how these markets could take off.

Of course, they’re not without their risks. Like any form of betting, it’s important to be smart—do your homework, manage your risks, and know when to walk away. But if you’re looking for something new and different, prediction markets could be the perfect fit.

Will prediction markets become the next big thing? Time will tell, but they’re definitely one to watch.

Frequently Asked Questions (FAQ)

Prediction markets make money by charging fees. When you place a bet, the platform usually takes a small cut of the winnings or charges a fee for each trade you make. Some platforms might also charge a fee when you withdraw your funds. The more activity there is on the platform, the more money they can make through these small charges.

Prediction markets can be pretty accurate, but they’re not perfect. They gather the collective knowledge and opinions of a lot of people, which often includes experts and insiders. This can lead to surprisingly accurate predictions, but there’s always some uncertainty. Predictions are based on probabilities, not guarantees—so while they can get it right a lot of the time, there’s no way to be 100% sure.

Some prediction markets use cryptocurrency, especially the decentralized ones. These platforms use blockchain technology, which is the same tech behind crypto, to ensure everything is transparent and secure. In these markets, you might use Bitcoin, Ethereum, or other cryptocurrencies to place your bets. However, not all prediction markets are crypto-based—many still use traditional money, so it really depends on the platform you choose.